Gold Bears Pull $20.8 Billion as BlackRock Says Buy: Commodities

By Elizabeth Campbell - May 13, 2013 9:04 AM ET

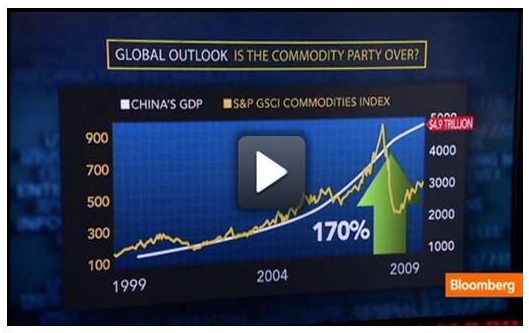

Is the Party Over for Commodities?

Hedge funds increased bets on lower gold prices after investors pulled a record $20.8 billion from bullion funds this year while BlackRock Inc. (BLK), the world’s biggest money manager, said it’s still bullish.

Speculators held 67,374 so-called short contracts on May 7, 6.4 percent more than a week earlier, U.S. Commodity Futures Trading Commission data show. The net-long position dropped 10 percent to 49,260 futures and options. Net-bullish wagers across 18 U.S.-traded raw materials climbed 5.8 percent to 582,265, with gains for cocoa, cotton and hogs.

Gold is having its worst start to a year since 1982 after dropping 15 percent and sliding into a bear market in April. Holdings in exchange-traded funds backed by bullion tumbled to the lowest since July 2011 even as central banks print money on an unprecedented scale to boost growth. BlackRock’s President Robert Kapito said May 9 he would still buy the metal, echoing billionaire John Paulson, who’s sticking with a bullish view even after losing 27 percent in his Gold Fund last month.

“People have been told the world is going to end for five years, and it hasn’t, so they’re finally moving on,” said James Paulsen, the Minneapolis-based chief investment strategist at Wells Capital Management, which oversees $325 billion of assets. “So even when crisis flashes now, you don’t get the same upside, and then in good times, you get more downside, and that’s what you’re getting in gold as the Armageddon premium is coming out.”

Gold Declines

Gold futures fell 1.9 percent to $1,436.60 an ounce on the Comex in New York last week. The Standard & Poor’s GSCI Spot Index of 24 commodities slid 0.3 percent, and the MSCI All-Country World of equities added 0.9 percent. The dollar climbed 1.2 percent against a basket of six major currencies. A Bank of America Corp. Index shows Treasuries dropped 0.6 percent. Gold for June delivery fell 0.3 percent to $1,432.60 an ounce by 9:02 a.m. in New York.

Bullion slumped last week after a May 9 government report showed the average number of Americans filing for jobless benefits over the past month dropped to the lowest since November 2007. Federal Reserve Bank of Philadelphia President Charles Plosser said that day unemployment will probably decline to 7 percent at the end of 2013 and he would favor reducing the Fed’s $85 billion monthly pace of bond purchases next month. Plosser doesn’t vote on policy this year.

Fund Outflows

Money managers withdrew $1.27 billion from gold and precious-metals funds in the week ended May 8, according to Cameron Brandt, the director of research for Cambridge, Massachusetts-based EPFR Global, which tracks money flows. This year’s outflows of $20.8 billion are the largest withdrawals since the firm began tracking the data in 2000.

A majority of the 38 analysts surveyed by Bloomberg last month predicted the metal will decline in 2013, ending a 12-year bull run. Billionaire investor Warren Buffett said May 2 that gold has no appeal even after the rout. The drop in global ETP holdings wiped $37.4 billion of value from the assets this year, while more than $4.6 trillion has been added to the value of global equities, data compiled by Bloomberg show.

Paulson favors the metal even after his Gold Fund saw declines of about 47 percent this year, according to two people familiar with the matter. Paulson & Co. is the biggest investor in the SPDR Gold Trust (GLD), the largest bullion ETP. The metal helps diversify portfolios, BlackRock’s Kapito said in an interview with Tom Keene on “Bloomberg Surveillance.” Kapito said he would “still be a buyer of these short-term technical blips.” BlackRock is the top investor in the iShares Gold Trust.

India, China

Physical demand for gold drove an 8 percent gain in prices from a two-year low on April 16. Indian imports reached more than 100 tons in April, now valued at $4.7 billion, and shipments probably will top that again this month, according to refiner MMTC-PAMP India Pvt. The country’s gold imports were 860 tons last year, the London-based World Gold Council estimates. Consumption in China rose 26 percent in the first quarter from a year earlier, the China Gold Association said May 7.

Gold surged 62 percent since the end of 2008 as the Fed was joined by central banks in Europe and Japan in printing unprecedented amounts of money, almost doubling sovereign debt to more than $23 trillion, a Bank of America index shows. Twelve analysts surveyed by Bloomberg expect prices to rise this week, with 10 bearish and five neutral.

‘Lining Up’

“People are still lining up in China and India to buy the physical gold,” said John Kinsey, who helps manage about C$1 billion at Caldwell Securities Ltd. in Toronto. “Europe has got a stimulus program. The U.S. has a stimulus program. Japan has a stimulus program. You’d think there would be huge inflation coming with all this debt that’s being printed.”

Even as economists at Morgan Stanley and Credit Suisse Group AG predict policy makers will keep deploying stimulus, consumer prices have remained stable. Inflation expectations as measured by the break-even rate for five-year Treasury Inflation Protected Securities on April 18 reached the lowest since November.

Deutsche Bank AG cut its outlook for this year’s average gold prices by 6.4 percent to $1,533 on May 10. That would be the lowest annual average since 2010. The bank said last month the metal could drop to as low as $1,050.

Funds raised wagers on costlier crude oil by 5.5 percent to 204,534 contracts, the highest in five weeks, the CFTC data show. Investors trimmed bets on declining copper prices to a net-short position of 16,798, from 23,368 a week earlier.

Farm Bets

A measure of speculative positions across 11 agricultural products jumped 19 percent to 236,184 contracts, a fourth consecutive gain. Wagers on a corn rally jumped 35 percent to 61,632 futures and options. Investors boosted their net-short holding in wheat to 10,444, from 5,779 a week earlier.

The S&P GSCI Agriculture Index of eight commodities fell 1.7 percent last week, the third drop in four weeks. The gauge fell 5.5 percent this year. Global farmers will harvest the biggest grain and soybean crops ever, boosting food reserves, the U.S. government said May 10. U.S. corn inventories will double as farms recover from the worst drought since the 1930s.

“The decline in the commodity market that we’ve seen in the last several years coincides with inflation risk really being low,” said Nelson Louie, the global head of commodities at New York-based Credit Suisse Asset Management, who helps manage $10.9 billion. “Over the last several years, investors have gone into gold as market risk has become more elevated, but more recently as some of these issues have subsided, there’s been an unwinding of that trade.”